Taxable and non-taxable sales. India and Malaysia held top defence-level talks on Monday with a focus on the Tejas Light Combat Aircraft offer as well as sustenance of the Russian origin Su30 MKM fleet of the Malaysian Air ForceThe talks took place via video conferencing between defence minister Rajnath Singh and Malaysias senior defence minister YB Dato Seri HishammuddinTun Hussein.

The IRS will only agree to a PPIC if its clear that the monthly payments you can make will not cover your total taxes due for many years.

. Signup for a Free Trial. ClearTax GST Software simplifies GST Return Filing GST Invoices and provides Free Hands on GST Training to Tax Experts Businesses. Tax invoices sets out the information requirements for a tax invoice in more detail.

Less than 75000 annual turnover or 150000 for non-profits Lodge. E-submission of GST registration Form F1 3. But youre still required to pay a quarterly instalment of the GST you owe.

You must submit a BAS within 21 days of the month closing. At the end of the term. Best health insurance for senior citizens above 60.

Registration of GST one-time-fee - 500 including. Traditional local installation software approach is very inconvenient and expensive. Submit with income tax return.

She pays 22 including 2 GST. Alice can claim a GST credit of 2 on her activity statement and 20 as an income tax deduction on her tax return. The amount of the premium is determined on the risk and the value of what youre insuring against at the time and may be subject to changes eg.

As in many nations air pollution linked to rapid industrialization is a public health and environmental concern in Malaysia especially in cities. A business not opting into the Quarterly Return and Monthly Payment of taxes QRMP. Review of the account.

GSTR 20131 Goods and services tax. Depending on the type of the insurance you may opt to pay the premium on a monthly or yearly basis. Alice a GST-registered computer repairer buys stationery for her business.

Passing diskettes CDs or USB between you and your accountant on quarterlymonthly basis can be challenging as it cut down the time available to verify your accounts and reduces. If you report GST and PAYG withheld monthly Xero produces a BAS each month that reports both PAYG withheld and GST. Prices are per active employee per month including GST.

Account Transaction with input GST and output GST to be provided by the Company 2. This study presents a cross. Reply to IRAS query regarding GST registration only.

Understanding awareness of air pollution and support for environmental protection from the general public is essential for informing governmental approaches to dealing with this problem. Another option to reduce your total tax liability is an offer in compromise OIC. Review information document required for GST registration 2.

If you supply or receive an invoice that only has a figure at a wine equalisation tax-goods services tax WEG label you need further information to claim GST credits and for it to be considered a valid tax invoice. If the IRS accepts an OIC. 10K Network Hospitals Pre Post Hospitalisation Day-care Buy affordable medical insurance for senior citizens by HDFC Ergo.

Businesses registered for GST. Less than 20 million annual turnover. When you run your BAS Xero automatically calculates GST and can populate the W1 and W2 fields based on your Activity Statement settings.

An employee will be considered active when at least one of the following actions has been completed for that employee during a calendar month. - Included in a finalised pay run even if that pay run is subsequently unlocked - Has had an approved leave request - Has had an approved expense request - Has had a. W ith monthlyquarterly GST submission it is crucial that your accounts are prepared in timely order and accurately.

Youll need to enter additional tax areas such as FBT FTC WET or LCT manually.

Tweets With Replies By Ema Sg Ema Sg Twitter

Gstn Enabled New Options For Quarterly Returns Monthly Payment Scheme On Gst Portal A2z Taxcorp Llp

Advisory On Filing Gstr 1 For Jan Mar 2021 Under Qrmp Scheme A2z Taxcorp Llp

Katherine Rusk Jones Senior Accountant Heartland Cpas Linkedin

How To Manage Conditional Sales Tax In Dynamics 365 For Finance And Operations Hitachi Solutions

Eztax In Easiest Accounting In 8 Countries Accounting Software Accounting Online Accounting

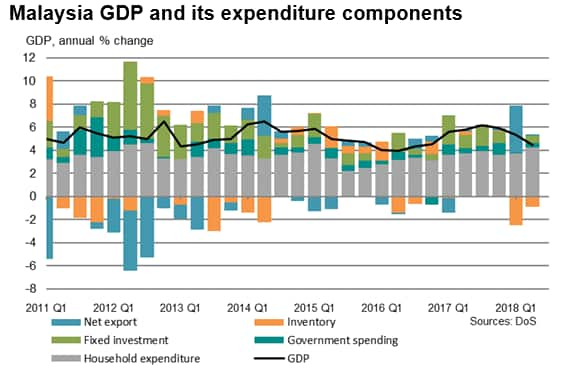

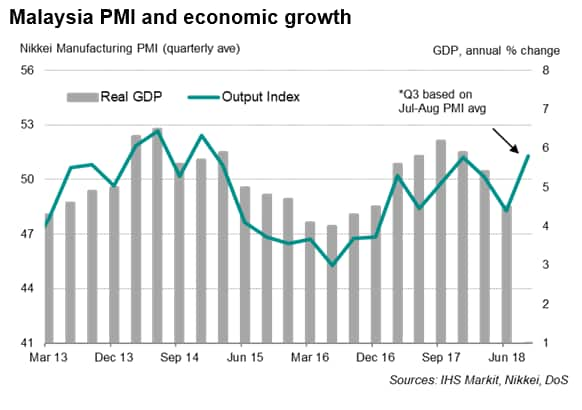

Malaysia Manufacturing Pmi Hints At Q3 Upturn After Slower Q2 Ihs Markit

Simon Ng Executive Director Global Head Of Gsac Bond Pricing Emea Apac Head Of Corporate Credit Operations S P Global Linkedin

How To Collect And Pay Sales Tax In Quickbooks Desktop Youtube

Qrmp Scheme Quarterly Return Filing Monthly Payment Of Taxes

Malaysia Manufacturing Pmi Hints At Q3 Upturn After Slower Q2 Ihs Markit

Electricity Tariff For S Pore Homes To Rise By 5 6 In 1q

The Latest Enhancements To The Canadian Gst Hst Return Xero Blog

Top It Companies See Significant Drop In Operating Margins For Q4 The Hindu Businessline

Abolition Of Gst And Transition To Sst In Malaysia Activpayroll

Vat Returns Hmrc Vat Return Rules Rules Cool Kitchen Gadgets Return